Binary Options 60 Second Trading Strategies

Binary Options 60 Second Trading Strategies

December 1, 2012The more research I conduct on 60 second trading strategies in binary options, the more I am shocked at the wide spectrum of tools available for anyone looking to invest. Out of everything that’s out there (and there’s a lot), I was able to come up with a few winning strategies that always give me the extra edge I need in order to profit.

Taleb Distribution

In his book Fooled by Randomness Nassim Nicholas Taleb examines the concept of chance in our daily lives and how it influences our actions. In trading, this strategy describes a returns profile that can be misinterpreted as a low-risk system with consistent ROI, however in reality we all know the contracts expire out of the money more than what one may originally predict.

The Taleb distribution does not describe a kind of statistical probability distribution, and is not associated with various mathematical formulas. The whole concept is built around the idea of an ROI profile with a high probability of a moderate gains, but by the same token a low probability to absorb large losses. In other words, it is a risk management strategy designed to give you a statistical edge.

When analyzing the expected value in various types of trading scenarios, you can immediately see the dominating presence of low risk and consistent return on investment ratio.This leads us to kurtosis risk and skewness risk. Extreme events are known as Kurtosis, and they influence the overall ROI dramatically.The Skew or skewness risk is more commonly referred to as the downside. So let’s say you have an open position on AAPL and you are making a put call on 24option after you just identified a dark cloud cover followed by a bearish confirmation. If you staked $1,000, and your contract expired in the money, you would have gained up to $850 in 1 minute of trading.

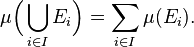

Expected Value Formula

The Martingale Trading System

The Martingale Trading System

The Martingale system basically takes into account a mathematical premise that when you lose, the probability of you losing the second time consecutively decreases. So, every time you have a “losing trade” you double up based on a statistical predictive model that if followed correctly, can increase the amount of winning trades. In complete contrast to the Taleb distribution, the Martingale system increases risk based on probability and assumed outcome. If you are an amateur trader I highly recommend you stay away from this method (particularly when combined with 60 second) since I have seen too many people making mistakes and losing massive amounts of money.

Trading the News

When trading 60 seconds following the actual news is not an important factor because there is no sufficient time to start analyzing financial news and implementing your insights into a trading strategy. Strictly speaking, 60 second trading is pure financial betting and the level of knowledge and experience you have hardly has any bearing on the outcome.

Technical Trading

This form of trading is based on liquidity and market volatility. Liquidity lets you to enter and exit positions at an optimal price (i.e. tight spreads and low slippage). Volatility measures the expected price range on any trading day. The higher the volatility levels are, the bigger the profits or losses. In other words higher volatility means higher risk.

TIP! Once you choose a certain stock, you must identify the best entry and reversal points. Using and understanding the candlesticks is critical. Looking for spikes, Doji candles, and prior support line indicators at price levels are just a few of the tools at your disposal.

Scalping

Scalping is one of the most used trading strategies. The scalper will always sell his stock immediately (or almost immediately) after a trade turns a profit. In this case the price target is achieved right after the point of profitability. This is classic for moving in and out of trades on a high frequency strategy.

Pivoting

This strategy is based on profits originating from a certain stock’s daily volatility levels. Pivoting is done when you purchase stock at the low of the day (LOD) and sell it at the high of the day (HOD). Transition from buy to sell occurs immediately when the reversal signal is evident. Again, in this context pivoting is less relevant unless you use it as one indicator or entry signal for entering a position.

Momentum Trading

I have written about momentum in one of my previous posts, but to put it plainly this strategy based on “trading the news” and/or identifying clear trend signals based on high volume levels. To illustrate, lets say you hear a skirmish has broken out in the Middle East and the markets are starting to get bullish on oil stock. When a news article appears you will immediately want to sell your options on the upside and buy on the down side knowing the the stock prices will regress towards the average (as mentioned previously this strategy is less effective). Exiting the position is crucial because you want to implement your reversal strategy when you see the bearish candles. In other words, after you make your initial deposit select and enter the 60 second trading box, you simply choose the “below” or down option, meaning you believe the price will fluctuate below the resistance line.

To Sum Up

When choosing your strategy you must carefully select the platform and the broker you choose to work with. Some platforms are more sensitive to bonuses, while others have lower trading requirements but will give lower deposit incentives. Bigger bonuses mean you have a bigger balance and can leverage this to open more positions and scalp by stepping in and out of trades quickly. If you are smart and understand that you need to lose some trades in order to avoid getting picked up by the risk managers you are on your way to making a lot of money trading binary options.

Incoming search terms:

- 60 second binary option strategies

- 60 second binary options strategies